$15 MILLION NET WORTH LIFESTYLE

Do you dream of a $15 million net worth and the luxurious lifestyle it could allow? The lifestyle of a mid-eight-figure account opens the door to experiences and facilities that are only available to a select portion of the population. From extravagant supercars and luxurious mansions to globetrotting on private jets, having a $15 million account allows you to live an authentic lifestyle of elegance.

INTRODUCTION

Achieving this coveted status of people with high net worth requires decades of dedication to strategic investing and innovative wealth management. The most common routes include achieving success in areas with high earnings like entertainment, finance, and technology and even starting your own business, which offers an incredible return after years of work. Many people amass wealth through carefully managed inheritances or money passed on over generations.

Whatever way you accumulate the $15 million when reached, it will grant entry into the highest rungs of money. This is the highest level of financial security. But what will your life be like when you reach this amount of money? What are the unique experiences and items that are now accessible at this point? Let’s look at the lavish lifestyle of the 15 million net worth group.

ACCUMULATING $15 MILLION NET WORTH

Attaining the coveted 15 million mark in net worth that grants you the door to lavishness requires a lot of effort, intelligent financial choices, and a bit of luck. Although incomes exceeding millions a year could help, it usually takes years of devoted spending and saving practices to accumulate wealth that size.

Many professionals in the field of technology who sell options to purchase stock following an IPO or purchase end up at or above the $10 million net worth bracket. Business owners with a successful track record of building companies over time and then deciding to sell or take their company publicly often make nine-figure fortunes. People who climb the corporate ladder with high-paying fields such as law, finance, or healthcare can accumulate millions of dollars in net funds.

Investment options

Investor bankers, hedge fund managers, and venture capitalists typically achieve the mark of $15 million when they earn huge profits as they prudently manage their cash. Famous actors with blockbuster film and record album sales endorsement agreements are now part of the super-rich. Professional athletes competing in sports like football, basketball, and boxing see their incomes rise, which makes it possible to make a substantial amount of money.

Whatever way the cash is earned, bringing it to the level of $15 million or over requires experts in wealth management to safeguard the assets and maximize tax efficiency. Wealthy people diversify their portfolios of property, stocks, and businesses to balance the risk of return. Affording a reasonable lifestyle and restricting excessive lifestyle the cost of living are also essential.

By focusing their efforts and taking the correct steps, nearly anybody can attain a 15 million dollar net worth over their work years. All it takes is dedication to your financial goals and perseverance to see investments grow significantly.

LUXURY HOMES WORTH MILLIONS

When you join the famed 15 million net worth group, one of the most sought-after acquisitions is the chance to have multi-million dollar fantasies in glamorous places all over the globe. Luxurious mansions, beachfront villas, and sprawling ranches are feasible when money isn’t limited.

The most luxurious real estate available in communities such as Beverly Hills, Palm Beach, Aspen, and the Hamptons has stunning homes that start with a price of $10 million. At $15 million, nine-figure fortune-seekers can purchase stunning estates with every luxury. These include court-like basketball indoors, theaters in homes, wine cellars, infinity pools, and guest homes. Mansions that are priced this high usually have 10000 square feet of living space surrounded by a landscaped acre of grounds.

With a part of their fortune, wealthy people purchase excellent vacation properties in locations such as Lake Como, Italy, Cabo San Lucas, Mexico, and the Bahamas. Islands within the Caribbean are available for private property. There are many options for luxurious living. Are virtually endless when you have an estimated net worth of $15 million.

The architectural customization allows for unique mansion estates. For those who love cars, massive garages can house a range of luxurious vehicles, all within the same under one roof. In this type of luxury, the dream homes that match the luxury of a mansion are now a reality.

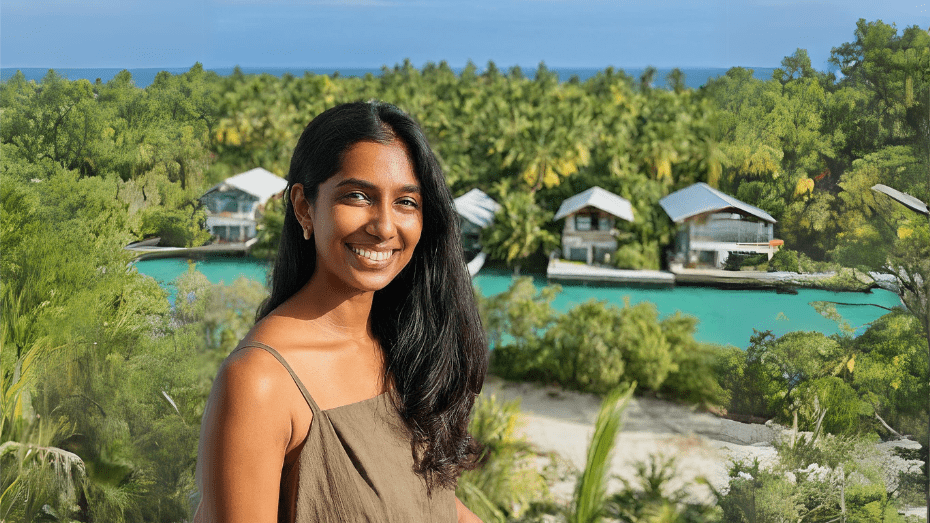

LUXURY TRAVEL AROUND THE WORLD

Apart from the multi-million dollar properties, one of the most significant benefits of joining the 15 million net worth club is the chance to travel globally and in fashion. Private jets take you to an glamorous location at your heart’s whim. Chartering luxury vessels gives exclusive access to islands as well as private beaches. One of the most luxurious vacation experiences can be found.

Instead of commercial flight aircraft, the ultra-rich can pay $3,000 per hour for privately owned Gulfstream jets, which can fly for hours wherever they want. To maximize freedom, fractional jet ownership lets you access a fully decked-out aircraft at the whim of. Contrast this with flying first class on commercial flights.

Mega yacht charters equipped with landing pads for helicopters and movies, pools, and many more permit millions of dollars to sail across the Mediterranean, Great Barrier Reef, and beyond in extravagant high-end luxury. The floating mansions are equipped with facilities that are only imagined by millionaires.

The bucket list of trips is also feasible, such as African photographic safaris, excursions to the Galapagos Islands, stays at Overwater bungalows in Bora Bora, and visits to the entire Seven Wonders of the World. There is no fascinating location possible with just an estimated $15 million.

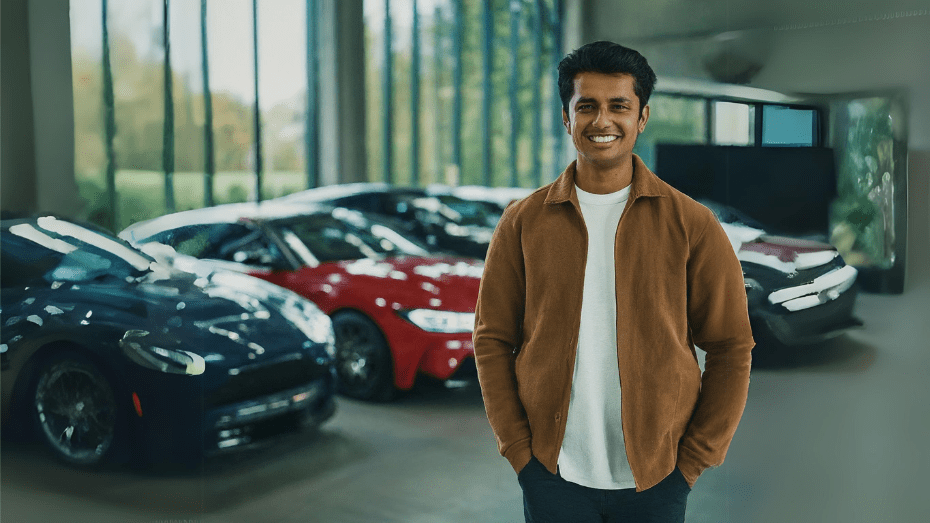

SUPERCARS AND VEHICLE COLLECTIONS with $15 MILLION

An elite collection of luxurious supercars valued at hundreds of thousands is part of the garage, with an estimated $15 million of cash. Car enthusiasts will find few things more satisfying than creating and acquiring the world’s most coveted luxury cars.

Brands such as Ferrari, Lamborghini, McLaren, Porsche, and Aston Martin offer cars ranging from $200,000 to $300,000. Price range when outfitted with high-end choices. Multi-millionaire owners will add these cars to their collection every few years, similar to other buyers of new smartphones.

The highly scarce 3 million Bugatti Chiron supercar delivers 1500 horsepower, making it the ultimate journey. Mercedes AMG Project One hybrid hypercars set to go under the hammer at $5 million will draw gasps during exclusive auto exhibitions. The Aston Martin Valkyrie AMR Pro racecar clicks from 0 to 60 mph in three minutes.

With a net worth of $15 million, the million-dollar hypercar garages can be a reality. The collection of vehicles at the very top of the line integrates luxurious vehicles seamlessly with the luxury lifestyle. Unique builds, rare purchases, and repairs that are not expensive guarantee that these cars remain the top jewels in rare collections.

LAVISH LIFESTYLES ON $15 MILLION

One of the most critical aspects of the 15 million lifestyles of net worth is the capacity to give back a significant amount and leave an enduring legacy. The elite financial strata will allow for a transformational level of charity giving for causes that are dear to our hearts.

Donations of a significant amount can be given to schools of the past to create scholarship funds, construct buildings, and support programs for the long term. Naming rights are granted with nine-figure donations. Wealthy people can create their own charitable foundations and establish annual budgets for giving that are in the thousands.

Another possibility is to create a donation-advised fund with a starting balance of around $10 million, which allows for significant grants to be disbursed in time to various charities. These funds provide charitable reports and take care of every aspect of administration.

If you’re looking to impact the world during their lives, the amount of $15 million will allow for large-scale assistance of initiatives like medical research, conservation of nature homeless, and accessibility to education. A significant social change could be created if the funding is readily available.

As a result, strategic philanthropy and the planning for legacy help ensure a lasting positive impact that extends past one’s life. Giving a lot increases with a 15 million wealth.

PHILANTHROPY AND LEGACY on $15

MILLION

The uncommon $1 million net worth mark offers many opportunities; securing and enhancing wealth requires regular, professional wealth management. Advisors’ advice helps avoid common mistakes, including overspending and investment risks.

Strategies involve diversifying your assets among bonds, stocks, real estate, and alternative investments to keep a balance between risk and returns. Techniques to optimize taxation, such as the donor-advised fund, charitable trusts, and opportunity zones, help to reduce the need for tax.

Firms that manage wealth offer personalized services such as bill-pay, concierge services, and a 24/7 helpline. If you are at $15 million upwards, every financial aspect is taken care of from behind.

The most significant benefits of wealth advisors are their advice on stewardship – helping make intelligent choices, accountable spending, and passing wealth on to inheritors with prudence throughout generations. Being within one’s means and staying away from excessive inflation in lifestyle is crucial.

By utilizing a constant counselor and monitoring budgets, the $15 million net worth of persons can sustain and increase their wealth. Consulting with professionals gives security and peace of mind. It also unlocks some of the most enjoyable aspects of the process.

FINANCIAL PLANNING AND WEALTH MANAGEMENT

The protection and preservation of a $15 million fortune is a constant effort that requires management and guidance from an expert. Through collaboration with financial advisors and wealth management, people with high net worth can maintain their privileged status for the next generation.

Strategies consist of diversifying assets through a balanced portfolio that includes bonds, stocks, private equity, real estate, and other alternatives to investing. This can provide opportunities for growth in the future while also reducing risks. Wealth managers might suggest allocating 50-60% of your equity portfolio to diversified equities, 30-40% to fixed income, and the rest to natural options and assets.

Wealth transfer and tax optimization strategies are becoming increasingly important. Trust structures, donated fund opportunities zones, and charitable planning enable the wealthy to reduce the tax burden and increase inheritance to the heirs. It is essential to consider the location of your residence. Florida and Texas, without income tax, are some of the most popular states to locate a residency.

Gaining access to the top wealth advisers provides personalized services such as billing, concierge management, and 24-hour support. If you have a net worth of $1 million, the financial aspects are managed seamlessly in the background. However, the best benefit of stewardship is continuous spending, investment, and legacy planning.

Luckily, lucky people can preserve and increase their assets by making wise decisions and staying clear of excessive lifestyle inflation. Through constant guidance by financial professionals, the $15 million amount offers plenty of opportunities without going overboard.

CONCLUSION

The rare 15 million net worth allows access to the most luxurious luxuries and adventures life can provide. Glamorous homes, lavish residence cars, glamorous collections of luxury vehicles, and complete financial independence have become the norm of everyday life. Although the club is still highly exclusive, many people can make decisions and discipline over time.

More importantly, a 15 million wealth can enable substantial philanthropy and legacy planning, which can positively transform people’s lives and the community. The capacity to contribute to charity increases dramatically with this amount of wealth. If you follow the advice of Wealth management experts, a wealth-rich and balanced lifestyle is an achievable reality.

Although the trappings of a super-rich lifestyle may be appealing, pursuing fulfillment and meaning will ultimately be more satisfying. When you’re fortunate enough to attain an annual net worth of $15 million, staying focused and using assets responsibly without wasting them allows this achievement to provide maximal life satisfaction.

FAQs

A: It typically takes an annual income of at least $1-2 million sustained over 10+ years to reach a $15 million net worth through savings and investments. However, larger one-time windfalls like company sales or inheritance can also push someone to this level.

A: The effective tax rate on $15 million of assets producing income would typically be 15-25% depending on the types of investments and how aggressively tax optimization strategies are implemented. Long term capital gains and dividend tax rates are generally lower.

A: At today’s rates, $15 million could generate $450,000+ in annual interest income. This covers living expenses for many, but dipping into principal is often still required to maintain an upper class lifestyle.

A: Annual costs for a $15 million home typically total around 5-10% of the value. This covers property taxes, insurance, utilities, maintenance and staff. So around $750,000 to $1.5 million per year.

A: Most lenders require an annual income of at least around $750,000 to qualify for financing a home in the $15 million price range. Down payments of 20%+ are also typically required.