Introduction

India, a major player in global rice exports, faces challenges as the government imposes bans and price caps on rice exports. KRBL, a leading rice exporter, discusses the impact of these regulatory changes on its business and outlines its strategies for navigating these challenges.

KRBL’s Struggle Amidst Export Restrictions

Decline in Export Revenue

KRBL, known for its flagship basmati brand, India Gate, reported a significant 60% year-on-year decline in export revenue in the second quarter of the current financial year. This drop is attributed to lower bulk and branded sales in key markets, impacted by the government’s ban on non-basmati white rice exports and the price cap on basmati rice exports.

Changing Revenue Composition

As of the end of FY22, exports contributed approximately 37% to KRBL’s revenues, down from 50% in the previous year. The ban on non-basmati white rice exports and the price cap on basmati rice further challenge the company’s revenue mix.

Government Regulations and Impact

In July, the Indian government implemented a ban on non-basmati white rice exports to control domestic retail prices. This move affected nearly 50% of India’s total rice exports, including non-basmati and broken rice. Additionally, a minimum export price (MEP) of $1,200 a ton for basmati rice was imposed, later reduced to $950 per tonne due to hindrances in sales.

KRBL’s Response and Future Outlook

Shift in Export Dynamics

KRBL engages in bulk exports of non-basmati rice when favorable margins can be secured. However, changes in government regulations, particularly regarding exports to China, impacted the company’s ability to continue such exports, leading to a YoY drop in export revenue.

Distribution Challenges and Optimism

Distribution challenges, especially in crucial markets like Saudi Arabia, have contributed to the lackluster performance in the export market. Despite this, Ashish Jain, CFO of KRBL, expresses hope for resolving these challenges soon. The normalization of distribution in Saudi Arabia is crucial, considering it accounts for 80-85% of India’s total basmati exports to the Middle East.

Domestic Business Growth

While facing challenges in the export market, KRBL remains optimistic about its domestic business. The company’s domestic revenues have seen impressive growth, with a 35% YoY increase in the second quarter and a 27% YoY increase in the first half of FY24. Double-digit growth in consumer and bulk pack segments reflects a positive trend in the domestic market.

Financial Snapshot and Market Position

Financial Performance

KRBL’s standalone net sales saw a slight decline of 8% at ₹1,213.39 crore in September 2023, compared to ₹1,319.28 crore last year. The quarterly net profit also decreased by over 28% from ₹213.11 crore to ₹153.14 crore.

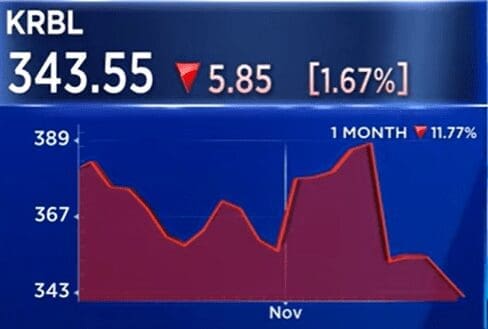

Market Capitalization and Share Performance

Known for India Gate, KRBL holds a market capitalization of ₹8,090 crore. While the company’s shares were trading around 2% higher on the NSE at ₹350 apiece, they have experienced a recent dip of nearly 8% over the last month compared to the benchmark Nifty 50’s marginal gain of 0.34%.

FAQs

- How much did KRBL’s export revenue decline in the second quarter of the current financial year? KRBL reported a significant 60% year-on-year decline in export revenue in the second quarter.

- What contributed to the decline in export revenue for KRBL? The decline is attributed to lower bulk and branded sales in key markets, influenced by the government’s ban on non-basmati white rice exports and the price cap on basmati rice.

- What percentage of KRBL’s revenues did exports contribute in FY22? As of the end of FY22, exports contributed approximately 37% to KRBL’s revenues, down from 50% in the previous year.

- What government regulations affected KRBL’s bulk exports of non-basmati rice to China? Changes in government regulations, particularly regarding exports to China, impacted KRBL’s ability to continue bulk exports of non-basmati rice.

- Which markets pose distribution challenges for KRBL in the export market? Crucial markets such as Saudi Arabia present distribution challenges for KRBL, affecting its export performance.

- How has KRBL’s domestic business performed amid export challenges? Despite export challenges, KRBL’s domestic revenues have grown impressively, with a 35% YoY increase in the second quarter and a 27% YoY increase in the first half of FY24.

Conclusion

The article sheds light on the challenges faced by KRBL, a key player in India’s rice exports, due to government regulations. As the company navigates export restrictions, its focus on domestic growth and strategies for overcoming distribution challenges will play a crucial role in shaping its future in the evolving rice market.