Invoice Discounting Concept – Is invoice discounting a good idea?

Is invoice discounting a good idea? Invoice Discounting Concept – Low-Risk High Return Investment Opportunity, If someone says to you that – ‘There’s an investment opportunity where risk is low and returns are high’ Will you believe it? If you want good returns with low risk then this video is for you. We all have heard that where there are high returns, the risk is high too. And where there are low returns, the risk is also low there.

This thing is actually true. But wait, there’s a twist. Any investment’s risks or rewards depends on these 3 things –

1) Nature of Investment This means your investment is short-term or long-term.

2) Liquidity Which means how early you can convert your investment into cash. For example Real Estate. In real estate, returns are quite good but liquidity is low. If you want to sell your home tomorrow, you can’t sell. To sell it or we can say to convert it into cash you need lots of time. You need to take care of investments in which liquidity is low.

I am saying it because – Where liquidity is low If you by chance commit any mistake while investing then you can’t get out of this investment early. For example, you bought a company’s stock. That stock is not performing well and started falling. Then you can easily sell that stock the next day and exit from the investment. But you can’t do the same thing with real estate.

3) Parties Involved Which means your investments are going to whom. In peer-to-peer landings, returns are very high. But in this scenario, the risk of losing all your money is high too. The risk is high because the parties which are involved in these investments have low credibility. People want to make lots of money, but no one wants to take Financial Education.

Also Read: 5 Things To Know About Reflation Ray Dalio’s WARNING.

What is invoice discounting?

See Making money is very easy. But it’s easy when you have a proper financial education. This education is not given and will not be given in any school or college. There are many investment opportunities in this world, where you can earn high returns on low risk. But b’coz you miss these videos, you also miss these investing opportunities.

Today is what I am going to tell you. Using that financial instrument you can easily generate 11-13% returns yearly in just 2-3 months. If you are getting an average 12% yearly return then easily in 3 months you can make 3% returns on that investment. So the opportunity’s name is INVOICE DISCOUNTING.

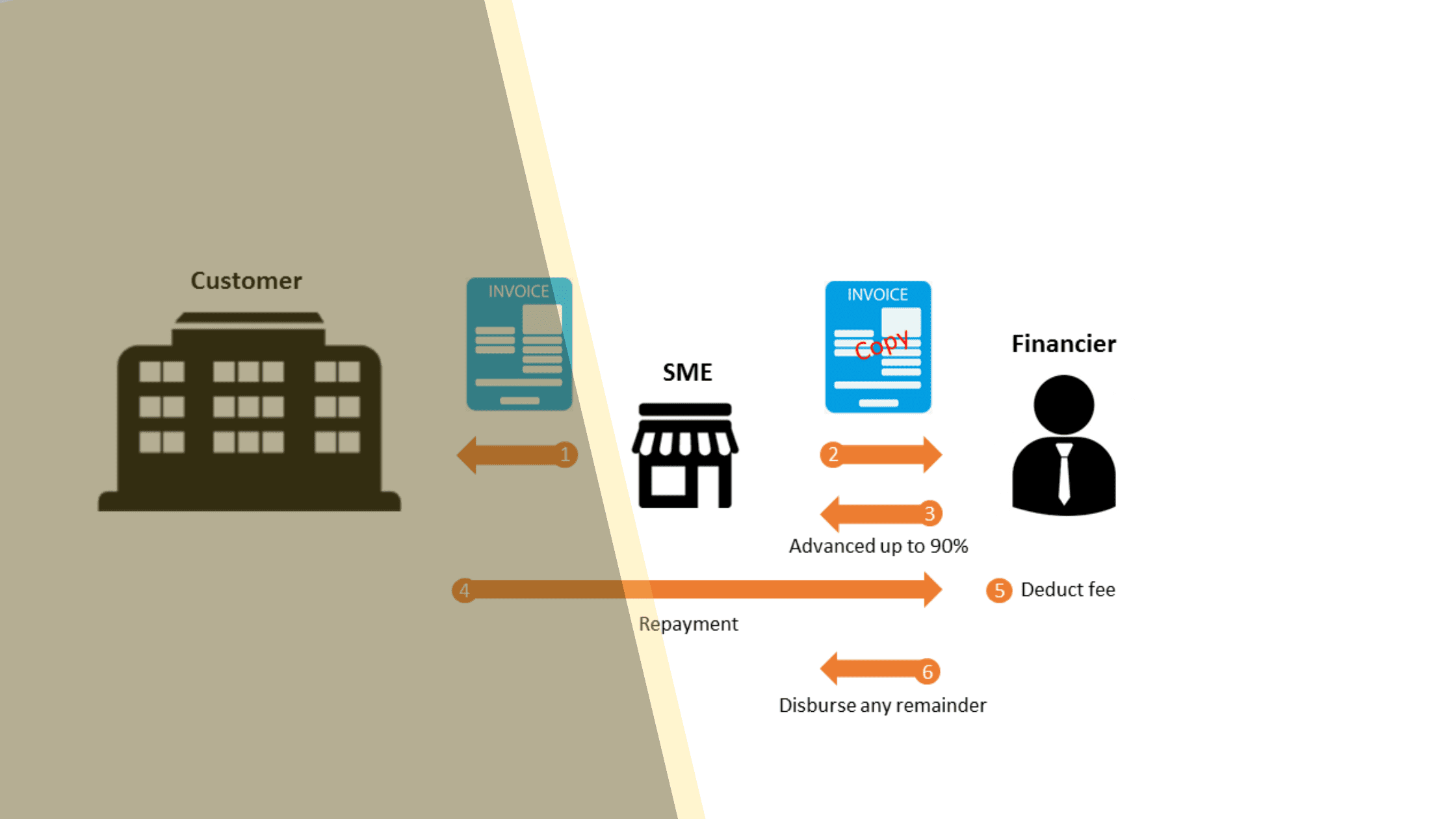

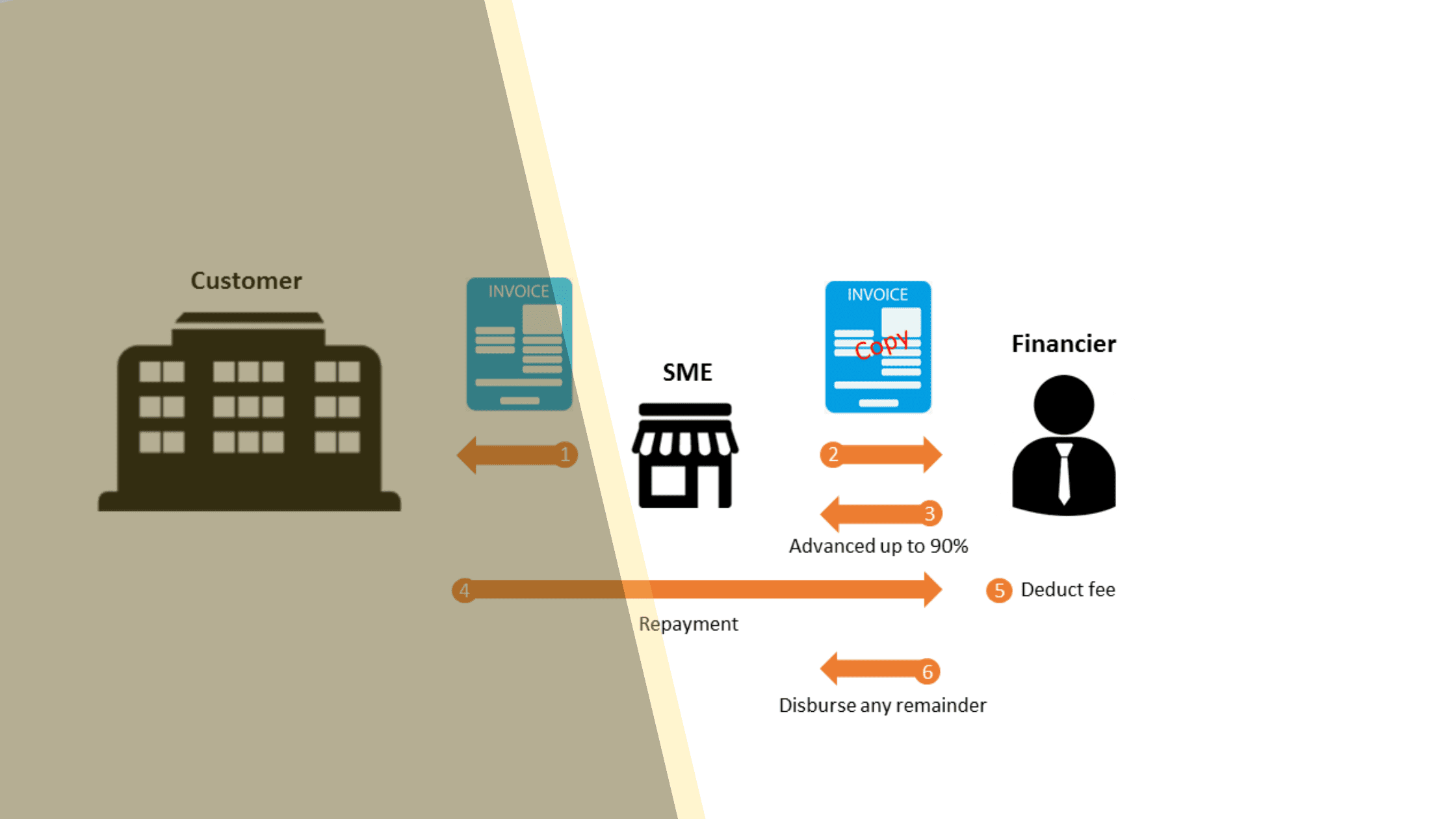

I know many questions would be coming to your mind. What is Invoice Discounting? How can it make good returns in less time? And if returns are high then why risk is low? And most importantly, how can we earn from this? So to understand all these things, first, you need to understand – What is Invoice Discounting? So there’s a vendor Shyam, who supplies goods to Amazon. Shyam supplied 10 lakh rupees goods to Amazon.

Now Amazon will not instantly pay Shyam. Let’s assume Amazon’s payment term is 60 days. So now Amazon took goods from Shyam but will pay him after 60 days. But Shyam wants money now. B’coz Shyam has many operational expenses and to bear it he needs money now.

So in this scenario, Shyam goes to the bank. Let’s assume he goes to ICCI Bank and says that ‘I have Amazon’s 10 lakh rupees invoice. That means 10 lakhs are going to come from Amazon. Can you give me some cash on it? ‘ Bank is not free, so why will they give this money to Shyam? In this scenario when the invoice is of 10 lakhs, the bank will tell Shyam that – ‘Don’t worry, If you want money then submit your invoice to us, we will verify it.

But I can give you only 9,70,000 Rs cash only.’ Now Shyam immediately wanted money so he took money from a bank in exchange for the invoice. And when after 60 days, when Amazon will return money to the vendor. This money will not go to the vendor but will go to the bank. But there’s a problem.

What is an invoice discounting example?

In Invoice Discounting, you can invest through a bank or high net worth individual. The question is How can common people like you and me make money from this? And this investing vehicle is so amazing that I don’t think anybody will not invest in it? So before 2018, for normal individuals like you and me It was not possible for us to invest in Invoice Discounting.

Also Read: 5 Proven Saul Investing Discussion

But now IT’S POSSIBLE. In 2018, Hardik Shah – a Qualified Chartered Accountant and Chartered Financial Analyst, After working for 8 years in the financial service industry, he started TradeCred. TradeCred is India’s biggest alternative debt platform. TradeCred is made so we can invest in low-risk high-return type investments like Invoice Discounting. But before TradeCred, this opportunity was available to banks and high net worth individuals only.

I know you would be thinking many things complex. You would be having many questions. How to invest? And if invest then in which invoices should we invest? And most importantly, what are those risk factors in this investment? So understand everything carefully. B’coz if you miss any of these things then your loss-making chances are very high.

invoice discounting platform

So starting from her, Firstly we will go to TradeCred’s website and Register. Fill in all your details and move ahead. Make sure all your details are right. Once you open your account, then log in to your account and go to the Move to Current Deals section. You can see many deals here. But before selecting any deal, decide how much money you want to invest.

Also Read: How To Make Money With NFTs (MY TOP 3) be a NFT Millionaire!

And deposit that much money into your account. Once you have deposited the money you want to invest, then you can explore many invoices. You could see many invoices. You can invest in the invoice of your choice. When you will invest in any invoice then on Dashboard, you will find how much return you will get there.

Is invoice discounting risky?

Now most important, Before you invest your money in these invoices, you need to know and understand the risk in them. So you can make smart investment choices. So what are the risks?

1) Defaults Many times it happens that the company makes defaults in paying payments to suppliers. By Shyam’s example, we understood that Amazon took goods from Shyam but now Amazon refused to pay money to Shyam by saying – ‘Your goods quality is not up to date/up to the mark.

We won’t pay you.’ But don’t worry, if you are investing in invoice discounting through TradeCred, you won’t face this issue. B’coz TradeCred has its own Risk Mitigation Tools. And TradeCred only works with highly trusted brands And due to this till now no payment defaults on TradeCred. No need to worry b’coz TradeCred takes security from borrowers in form of cash flow resources or security deposits.

2) Delayed Payments Let’s assume, Amazon took 75 days instead of 60 days. See on TradeCred, usually, this type of case is never seen. But if this happens with you then you will get interested in delayed days.

3) Fake Invoices Let’s assume, Shyam didn’t give any goods to Amazon and created a fake invoice and took 10 lakhs against it. Then what will you do in this case?

These things used to happen a lot in past. But don’t worry, this doesn’t happen on TradeCred. This is b’coz

1) TradeCred works with trusted brands and

2) All the invoices listed on TradeCred are verified and cross-checked.

One question would be coming into your mind. How does TradeCred’s mechanism work? Why should we trust it? So let me explain this thing with a simple example. So let’s understand this with Shyam’s example only. Let’s assume Shyam gave 10 lakhs of goods to Amazon. On receiving these goods, Amazon gave a 10 lakh invoice to Shyam.

And said we will pay you after 60 days. But Shyam wants payment now. Shyam goes to TradeCred and lists his invoice. TradeCred will first verify this invoice from Amazon. Whether this transaction’s invoice is real or not. Once the invoice is verified, it gets listed on TradeCred’s platform. Here you can easily invest in this invoice.

Invoice discounting India TradeCred

Now TradeCred also gives you Trade payment records and deal reports. Here you can do all your due diligence. As an investor, I watch the deal, invoice and I find a good opportunity. Then I will give 10 lakhs to TradeCred. And TradeCred will give this money to Shyam. And after 60 days, when it’s time for Amazon to pay this invoice.

Also Read: Proven single stocks and mutual funds Venn diagram 2022

Amazon will not pay this into Shyam’s account. This money will directly go to TradeCred’s escrow account which is in ICICI Bank. And from there it goes to the investor. This money goes to me – the investor and with interest. I know you would also be having questions about taxes. No TDS but your interest income is taxable.

And rate depends on which tax slab you belong to. Now only one question is left – In which invoice should we invest? And in which invoice we should not invest? To know in which invoice to invest, check these 2 things. If you see the green flag in these 2 things then you are good to go.

Otherwise don’t invest in that invoice.

1) Company’s Past Record Check the company’s past records. Has the company paid to all their creditors or made defaults. If a company makes defaults regularly then I advise to not to invest in that invoice.

2) Company Financials Check how strong are company’s financials. If there’s too much debt on the company if cash flow is not good. That is the company is not getting cash regularly then there are high chances that your invoice will be a default. So don’t invest in that invoice.

Only invest in that company’s invoice in which there is surety of stable and secured company financials. They give their payments regularly and the company’s cash work position and debt are not very high that they can easily make payments. And many things you will automatically understand when you will explore TradeCred’s platform.

This opportunity is really amazing. And especially for those who want to get good returns on a short-term investment. If you got value from this Article then do like it. So this Article reaches to a maximum number of people and they also get value from this article. See you in the next Article. Till then keep growing.

Also Read: which of the following accurately describes socially responsible investing 2022