Introduction:

In a significant development, State-owned RITES Ltd clinched a momentous contract for 10 diesel-electric locomotives from CFM Mozambique. The announcement, made on Friday (November 17), marked a turning point after RITES emerged as the lowest bidder in two tenders from CFM Mozambique. This article delves into the intricacies of the contract, financial implications, and the broader context of RITES’ recent ventures.

1. RITES Emerges Victorious

Unveiling RITES as the lowest bidder in two tenders, the company’s shares soared to ₹477.25, witnessing a 6.10% increase on the Bombay Stock Exchange (BSE). This victory underscores RITES’ prowess in securing strategic contracts.

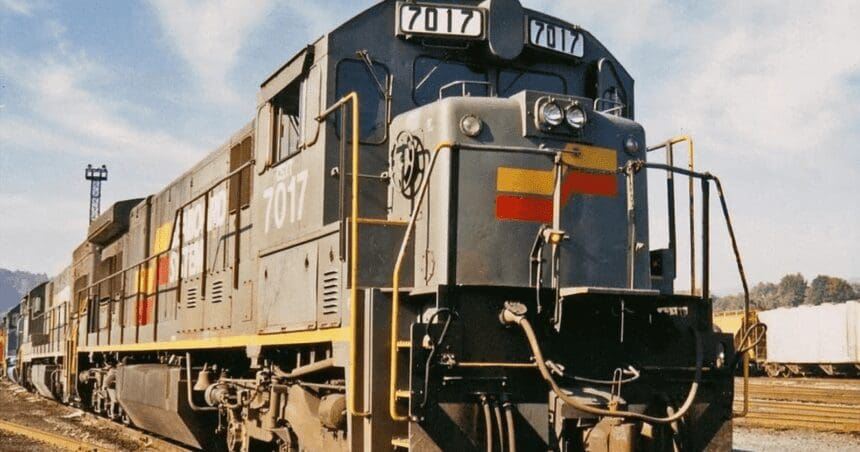

2. The Triumph: 10 Diesel-Electric Locomotives

RITES confirmed the award of the tender for 10 diesel-electric locomotives, with incidental services, valued at an impressive $37,680,080. The regulatory filing at exchanges conveyed this significant milestone achieved by the company.

Also Read: Stock Market: A Rollercoaster Ride to Success 23

3. Bidding Dynamics: Highs and Lows

While successful in the locomotive tender, the second part involving the supply of 300 high-side wagons took an unexpected turn. CFM Mozambique awarded the wagon contract to a different bidder, prompting RITES to provide bidders with the opportunity to contest the decision within three working days.

4. Financial Landscape: Second Quarter Performance

RITES faced a 21.4% decline in profit after tax for the second quarter, amounting to ₹110.17 crore. This dip, compared to ₹140.2 crore in the previous year, is attributed to decreased revenue. The consolidated income dropped to ₹608.81 crore, with factors like reduced export earnings and quality assurance revenue contributing to the downturn.

5. Diversified Services Portfolio

Beyond locomotives and wagons, RITES offers a spectrum of services, including transport infrastructure consultancy, railway inspection, rolling stock leasing, and maintenance. This diversified portfolio positions RITES as a comprehensive player in the transportation infrastructure sector.

Also Read: KRBL’s Diversification Strategy: Defying the Odds Against India’s Rice Export Ban 23

6. Market Response: BSE Performance

The market responded positively to RITES’ success, evident in the BSE closing figures. RITES Ltd’s shares ended at ₹477.25, reflecting a notable 6.10% increase, showcasing investor confidence and optimism.

State-owned RITES bags contract for 10 diesel-electric locomotives from CFM Mozambique – FAQs

How significant is the contract for 10 diesel-electric locomotives for RITES?

The contract is a major triumph for RITES, marking its emergence as the lowest bidder and securing a valuable deal with CFM Mozambique.

Why did RITES lose the contract for the supply of 300 high-side wagons?

CFM Mozambique awarded the contract for high-side wagons to a bidder other than RITES, leading to the initiation of a contestation period.

What contributed to RITES’ decline in profit for the second quarter?

RITES attributes the 21.4% decline in profit after tax to reduced revenue, particularly stemming from decreased export earnings and quality assurance revenue.

What services does RITES offer beyond locomotives?

RITES provides a range of services, including transport infrastructure consultancy, railway inspection, rolling stock leasing, and maintenance.

How did the market respond to RITES’ success?

The market responded positively, with RITES Ltd’s shares ending at ₹477.25, reflecting a 6.10% increase on the BSE.

What opportunities does this contract open up for RITES in the future?

Securing the contract enhances RITES’ market position and opens avenues for future collaborations and projects.

Conclusion

The contract for 10 diesel-electric locomotives signifies a remarkable achievement for State-owned RITES, reinforcing its standing as a key player in the transportation infrastructure sector. Despite challenges in the bidding process, RITES’ diversified service portfolio and market resilience position it for continued success in the evolving landscape.